She makes you sick, takes your money, then bumps you off

Blythe Masters and JPMorgan are made for each other.

That's what Blythe Masters of JPMorgan does based on evidence from the Federal Energy Regulatory Commission (FERC) and JPMorgan's recent history. (Image: UCS)

That's what Blythe Masters of JPMorgan does based on evidence from the Federal Energy Regulatory Commission (FERC) and JPMorgan's recent history. (Image: UCS)

Coal power is the leading source carbon dioxide (CO2) in the atmosphere. CO2 is the leading cause of climate change. Once airborne, the man made filth sticks around for 2 to 20 centuries. In addition, coal power is "a leading cause of smog, acid rain, and toxic air pollution."

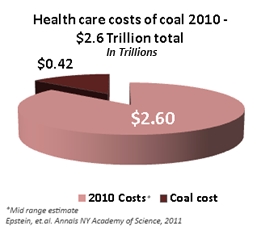

All that makes us sick reflected in a an annual health care price tag of $333 to $500 billion in costs for heart and lung diseases, for example. Tens of thousands die from those diseases eery year.

Guess which bank is one of the top financing sources for coal plants and mountain top removal? JP Morgan. That's the same JPMogan that the FERC may go after (just like the Department of Justice went after those involved with torture).

It is clear that Blythe Masters, head of commodities trading and regulatory affairs at JPMorgan investment banking, and her Wall Street cohorts who finance and lobby for coal production do not play well with others.

Blythe Masters, is in big trouble. The New York Times reported that a FERC report says that she lied to them about a deal and her expertise to squash state investigations. According to the Times, FERC alleges that Ms. Masters and her crew made appear that "money-losing power plants" were "powerful profit centers. Not good for investors.

Who is Blythe Masters?

Masters is a key player and senior executive at JP Morgan. She invented credit default swaps (CDS). This risky derivative scheme supposedly provides investors protection against financial default by corporate entities. You don't have to own one dime of stock in the corporation to buy protection, you just need the money.

The market size of CDS trading in 2012 was $27 trillion. It involves mostly foreign trading. The market is not regulated so all we can do is "take their word" on size and true risk. The market looks more like a protection racket than a financial service.

CDC trading is followed by a significant increase in corporate bankruptcy according to a recent study. Rather than providing protection, product marketing looks more like a protection racket. Master's invention was central to the 2008 financial crisis and CDS pose threats today.

We can debate the "great man/person" theory of history versus other causal factors all day long. It won't change the fact that JPMorgan's Blythe Masters is one extremely influential and dangerous person. She's walking around free as a bird, spending her money, never touched by the great financial collapse she helped create in 2008.

Our social and political culture is starting to mirror the musical Chicago with one important exception. Nobody ever gets arrested. They bypass that step and move right to notoriety.

END

This article may be reposted with attribution of authorship and a link to this article.

del.icio.us

del.icio.us Digg

Digg

Post your comment