Decline and Fall Special Edition: Healthcare Reform - Abandoning the Self-Employed

Business creativity and personalized services are on the chopping block, all because the self-employed can't afford their health insurance anymore than they can afford to risk their lives without adequate insurance. This did not happen by accident. Before it ever arrived at the president's desk for signature, the health reform act contained a poison pill for small business owners and the self employed..

The most creative sector of the business community has a dagger at its heart in the form of the relentless, unyielding, and over burdening cost of health insurance. The self-employed and very small businesses have seen their insurance premiums climb 20% to 75% since 2009. To purchase an adequate family plan, a self-employed person will pay an amount 50% to 70% of the nation's median personal income, $32,000 a year, for a family health plan. This includes premiums, deductibles, and out-of-pocket expenses. That is twice the cost for relatively generous plans at medium-to-large size companies. Very small businesses, two to 20 employees, pay about the same (Image: Paul Henman)

Wasn't health reform supposed to take care of just this sort of inequity? Didn't the title of the bill say it all? The Patient Protection and Affordable Health Care Act. There is no protection for the self-employed when they have these stark choices facing them due to unaffordable insurance rates. They can give up working for themselves; buy adequate insurance and take a huge hit to income; buy a substandard plan and hope that whatever comes up is covered, or, abandon insurance entirely at a real risk to their health and, in some cases, their lives.

What would the country be like if here were no self-employed individuals, no very small businesses?

Apple started out as two entrepreneurs in a garage. Microsoft began as a small tech company in Albuquerque, New Mexico. There is an impressive list of high revenue, high performing companies that traveled the route of self-employment and very small businesses.

The nation cannot afford to lose the extraordinary resources offered by the self-employed and very small business sector. It cannot afford the loss of small businesses that provide services like your favorite diner; solo and small group health practitioners; repair people; computer consultants; yard services; etc. The list goes on.

The nation cannot afford to lose the extraordinary resources offered by the self-employed and very small business sector. It cannot afford the loss of small businesses that provide services like your favorite diner; solo and small group health practitioners; repair people; computer consultants; yard services; etc. The list goes on.

Business creativity and personalized services are on the chopping block, all because the self-employed can't afford their health insurance anymore than they can afford to risk their lives without adequate insurance.

This did not happen by accident. Before it ever arrived at the president's desk for signature, the health reform act contained a fatal poison pill.

State Insurance Commissioners in Charge

The very same people who failed miserably to protect the self-employed and small businesses in the past are now in charge of protecting them in the future. They were written into the health reform legislation early on. They have powers to determine the share of insurance premiums spent on your medical care and much more.

We were told that the president's healthcare reform legislation was special; that it would force insurance companies to spend the following shares of insurance premiums on actual medical expenses: 80% for single plans (individual and family) and 85% of premiums for small businesses. This was implemented for 2010.

Medium- to large-sized companies self-fund their health benefits. They pay the costs and have insurance companies manage the plans. These firms already spend 85% or more of their health benefits on medical care.

The self-employed and very small businesses are different. They cannot self fund their healthcare. They must buy directly from health insurance companies.

That is where the state insurance commissioners come in. heir group is called the National Association of Insurance Commissioners (NAIC). This association wrote the federal regulations that define what is and what is not considered medical care. Their definitions influenced insurance premiums. By doing that, they determine how quickly companies have to meet the 80-20 or 85-15 ratios referred to as medical loss ratios (MLR). Prior to this national standard, MLRs required by state regulations were anywhere from 55% to 70% for medical care.

NAIC was named to write more than just MLR regulations for the act (see Appendix). The regulations are implemented by the federal Department of Health and Human Services. NAIC defines allowable delays to putting the ratios in place. It defines "market destabilization" and "credibility" factors that allow an adjustment of MLRs in favor of insurance companies. The state insurance commissioners association has the broadest of powers to determine the quality, quantity, and cost of medical care.

Hijacking Health Reform Legislation

NAIC is a $75 million dollar organization. A third of its income comes from health insurance companies who pay fees to access data that NAIS collects. The association gains income from the very organizations they are tasked to regulate in the states. These are also the same insurance companies who are highly dependant on the health reform MLR and other regulations NAIS is writing for the new health care act.

There is a clear appearance of undue influence on NAIC by the insurance companies that help fund the organization. In 1998, Ralph Nader wrote an open letter demanding independent funding for the group to reduce this influence. To make his point, Nader described a NAIC research finding on minority discrimination that upset the health insurance companies. The companies simply withheld payment for data fees, the core income for NAIC, until NAIC "backed off" of its position. The letter exposed an ongoing problem but failed to generate any change.

The organization lacks independence from the insurance industry. Skepticism about the organizations effectiveness is well justified.

NAIC is governed by twelve elected and thirty-eight appointed state health commissioners. Those running for election need campaign funds. Insurance companies are major contributors. Those appointed gain the office from governors. For the appointed, the contributions are just one-step away from the commissioners.

Elected and appointed commissioners have hefty political baggage. These are not the type of objective analysts and thinkers you want writing critical regulations that will affect your health.

These are just some of the reasons to expect little or no change in rates for those who purchase their insurance directly, primarily the self employed and small business owners. Were there any reason to expect change, the change should have arrived by now.

On October 21, 2010, we saw the future. NAIC announced that it had completed its model regulations on medical loss ratios. On the very same day, Kathleen Sebelius, Secretary of Health and Human Services (HHS), announced that:

"We will work quickly to promulgate this regulation, using the NAIC recommendations as a basis, because we believe these new policies will help ensure not only cost savings but higher quality care for consumers. We look forward to working closely with NAIC throughout the process." -- Kathleen Sebelius, Secretary HHS, October 21, 2010

Sebelius must be a very fast reader. I hope that she will read about the total failure of her favorite regulatory authors to gain any "cost savings' while they regulated insurance rates in their states for the self employed and small business. Then she might realize that "care for consumers" is not possible without affordable health care.

Don't hold your breath.

This article may be reproduced entirely or in part with attribution of authorship and a link to this article.

Appendix

I. Tax breaks to very small business

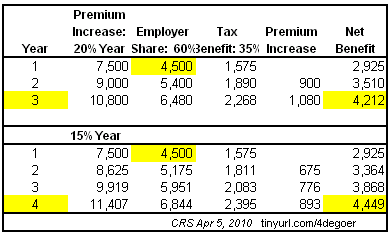

The tax provisions of the health care act were supposed to help very small businesses afford insurance for their employees. It appears that the tax breaks will lose their utility about the time that they expire. While they offer initial savings, premium increases wipe out the benefits of the tax cut in year three using the 20% per year increase and year four using the 15% premium increase.

Source: Summary of Small Business Health Insurance Tax Credit Under PPACA (P.L. 111-148) Congressional Research Service, April 5, 2010

II. The Influence of National Association of Insurance Commissioners (NAIC)

A) Political conflict of influence flow chart

This chart provides a graphic representation of the various potential conflicts of interest that raise serious questions about providing an association of elected officials and political appointees with vast regulatory power. After all, this is about our ability to stay well and deal with life threatening and other medical emergencies.

Also see:

B) NAIC in the health care act:

The Patient Protection and Affordable Health Care Act

- NAIC is mentioned through out the Patient Protection and Affordable Health Care Act. The association has vast powers which HHS is more than willing to give up. It is noteworthy that there are no formal ties mentioned between

- NAIC will help insurance companies in ", in compiling and providing to enrollees a summary of benefits and coverage explanation that accurately describes the benefits and coverage under the applicable plan or coverage" (p. 192, pdf).

- NAIC will determine the amounts for "reinsurance payments" for polls of high risk individuals without insurance based on its data (p. 209, pdf).

- NAIC will also help with standards for Medicare supplemental insurance (p. 460-61, pdf), fraud and abuse reporting (p. 780, pdf), and help with standards for Medigap programs (p. 460-61, pdf).

- NAIC has a special benefit. They have the privilege of total privacy, unlike the rest of us.

The transparency promised has not been delivered.

SEC. 6607. PERMITTING EVIDENTIARY PRIVILEGE AND CONFIDENTIAL

COMMUNICATIONS.

Section 504 of the Employee Retirement Income Security Act of 1974 (29 U.S.C. 1134) is amended by adding at the end the following:

(d) The Secretary may promulgate a regulation that provides an evidentiary privilege for, and provides for the confidentiality of communications between or among, any of the following entities or their agents, consultants, or employees:

(1) A State insurance department.

(2) A State attorney general.

(3) The National Association of Insurance Commissioners.

(4) The Department of Labor.

(5) The Department of the Treasury.

(6) The Department of Justice.

(7) The Department of Health and Human Services.

(8) Any other Federal or State authority that the Secretary determines is appropriate for the purposes of enforcing the provisions of this title.

(e) The privilege established under subsection (d) shall apply to communications related to any investigation, audit, examination, or inquiry conducted or coordinated by any of the agencies. A communication that is privileged under subsection (d) shall not waive any privilege otherwise available to the communicating agency or to an who provided the information that is communicated..

C) Medical Loss Ratio language

(1) REQUIREMENT TO PROVIDE VALUE FOR PREMIUM PAYMENTS.

A health insurance issuer offering group or individual health insurance coverage shall, with respect to each plan year, provide an annual rebate to each enrollee under such coverage, on a pro rata basis, in an amount that is equal to the amount by which premium revenue expended by the issuer on activities described in subsection (a)(3) exceeds --

(A) with respect to a health insurance issuer offering coverage in the group market, 20 percent, or such lower percentage as a State may by regulation determine; or

(B) with respect to a health insurance issuer offering coverage in the individual market, 25 percent, or such lower percentage as a State may by regulation determine, except that such percentage shall be adjusted to the extent the Secretary determines that the application of such percentage with a State may destabilize the existing individual market in such State. (p. 886, pdf)

(2) CONSIDERATION IN SETTING PERCENTAGES.—In determining the percentages under paragraph (1), a State shall seek to ensure adequate participation by health insurance issuers, competition in the health insurance market in the State, and value for consumers so that premiums are used for clinical services and quality improvements.

(3) TERMINATION.—The provisions of this subsection shall have no force or effect after December 31, 2013.

Also see:

REGULATION FOR UNIFORM DEFINITIONS AND STANDARDIZED METHODOLOGIES FOR CALCULATION OF THE MEDICAL LOSS RATIO FOR PLAN YEARS 2011, 2012 AND 2013 PER SECTION 2718 (b) OF THE PUBLIC HEALTH SERVICE ACT

- Federal Register December 1, 2010: Part III Department of Health and Human Services 45 CFR Part 158

Health Insurance Issuers Implementing Medical Loss Ratio (MLR) Requirements Under the Patient Protection and Affordable Care Act; Interim Final Rule

del.icio.us

del.icio.us Digg

Digg

Oh yeah. When you do your taxes you might find a cookie crumb in the form of a one-year credit for paying your outrageous premiums. It was Obama's and the GOP's little "gift" to small and self employed businesses as they ensured protection of the insurance industry. We'll never have real health reform until people wake up and realize that insurance companies are the death panels and they stand between you and your doctor. Insurance is not health care. We don't need insurance. We need care.

They also have quality of life death committees like the one that just nixed a friend's acne cream. Why you ask? Because -- according to them -- she's too FREAKING old to have acne, therefore doesn't need it!!!

If that isn't a mixed pile of B.S., H.S. and C.S., I don't know what is. And, if you ever visited a chicken farm you'd know why tossed C.S. into the fetid stew of insurance company medical-care-by-death-and-every-other-imaginable panel.

Even the Canadians are revamping their health care system to take it out of the hands of bureaucrats and back into the hands of doctors, per a tiny story I ran across last week in the Los Angeles Daily News. No URL, but I believe it came from UP.

Sandy, I share your sentiments. Get the bureaucrats and insurance companies out of health care. They add no value. That's an interesting story about Canada. Even as it is, their system is vastly superior to ours.

Post your comment