Decline and Fall - Why Would Anybody Believe Standard and Poor's?

The threat to downgrade the credit rating of the United States is a fraud based on a fiction. Standard and Poor's has no credibility.

We are in the midst of a bum's rush - the quick eviction of a less than desirable in an unpleasantly abrupt fashion. The problem is we're the bums. Our eviction from the political process is all based the word of a firm that helped fuel the housing bubble, trigger the financial collapse, and found itself indicted by the State of Connecticut for "unfair, deceptive, and illegal business practices" in 2008.

Last week, credit rating agency Standard and Poor's threatened to downgrade the AAA credit rating of the United States of America by issuing a "negative" finding on the 'long term credit outlook" for the country. The firm's report said that Congress wasn't working diligently enough to reduce the budget deficit. The nation had better fix things quick or, as S&P threatened, "there is at least a one-in-three likelihood that we could lower our long-term rating on the U.S. within two years [2013]." The mere threat of a reduced credit rating brought calls for quick and decisive action on proposals for deficit reduction.

Of course, decisive means cuts to social programs and the continued hijacking of payroll taxes intended for Social Security recipients. Where else will The Money Party steal the cash flow to reward themselves with bailouts, defense and more wars, plus those proposed subsidies for nuclear reactors?

Senator Tom Coburn (R-OK) was quick to express his faith in S&P and end rational citizen-informed discourse on priorities: "When S&P decides that the trend is negative and in facts sends a warning shot across our bow, I think there's not anything more significant we can do than come to an agreement." Senator Kent Conrad (D-ND) chimed in with more knee jerk rhetoric: "This is a defining moment. And we've got to decide as a nation, are we going to do some things that all of us would prefer not to have to do, or do we wait for the roof to cave in." The Hill, April 24

Why the rush? Why do we have to decide to accept a right-lite budget offered by the White House or a Medieval version of the nation's future from the ultra right?

Is S&P that smart? Is their reputation beyond repute, their objectivity unquestioned? Or is this some cheap political ploy for the continued subsidy of the financial elite by citizens?

S&P issue a variety of credit ratings. Investors use those ratings to evaluate the safety of purchasing securities and bonds. If a company, state, municipality, or financial product gets the highest rating, AAA, that tells investors that the entity is very unlikely to default on its debt. If S&P assigns a lower credit rating to corporate, municipal or state debt, then the corporation or government entity ends up paying higher interest rates for current and future debt. Higher interest rates divert funds from company revenues or government budgets due to higher interest rates. In the case of governments, that means fewer services.

Who in the World Would Trust Standard and Poor's - They Helped Trigger the Financial Collapse

Along with Moody's, S&P abruptly burst the real estate bubble and triggered the 2008 recession. Their downgrading of mortgage backed securities followed years of the highest ratings for these risky financial products. According to a US Senate committee report:

"Although ratings downgrades for investment grade securities are supposed to be relatively infrequent, in 2007, they took place on a massive scale that was unprecedented in U.S. financial markets. Beginning in July 2007, Moody’s and S&P downgraded hundreds and then thousands of RMBS and CDO ratings, causing the rated securities to lose value and become much more difficult to sell, and leading to the subsequent collapse of the RMBS and CDO secondary markets. The massive downgrades made it clear that the original ratings were not only deeply flawed, but the U.S. mortgage market was much riskier than previously portrayed." (Author's emphasis) US Senate Permanent Subcommittee on Investigations, April 13 (p. 263)

Did S&P and Moody's have a sudden epiphany about their ratings of risky investments?

The report goes on:

"The evidence shows that analysts within Moody’s and S&P were aware of the increasing risks in the mortgage market in the years leading up to the financial crisis, including higher risk mortgage products, increasingly lax lending standards, poor quality loans, unsustainable housing prices, and increasing mortgage fraud. Yet for years, neither credit rating agency heeded warnings – even their own – about the need to adjust their processes to accurately reflect the increasing credit risk." US Senate Permanent Subcommittee on Investigations, April 13 (p. 268)

The Senate investigation found that S&P succumbed to pressure for AAA ratings from Wall Street and big banks for their very risky mortgage backed securities (MBS) and other financial instruments that fueled the real estate bubble. That pressure resulted in high credit ratings while, according to the report, S&P knew from 2003 on that there were "increasing risks" in the MBS market. It seems S&P succumbed to pressure from their customers on Wall Street and the big banks.

"S&P Intentionally Underrates Public Bonds"

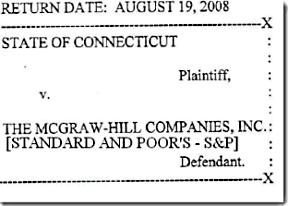

The heading above is a section title from the 2008 State of State of Connecticut complaint filed against S&P for "unfair and deceptive acts and practices in the courts of trade or commerce within the State of Connecticut."

The Connecticut Attorney General issued the following statement after filing the complaint against S&P:

"We are holding the credit rating agencies accountable for a secret Wall Street tax on Main Street"

"All three credit rating agencies systematically and intentionally gave lower credit ratings to bonds issued by states, municipalities and other public entities as compared to corporate and other forms of debt with similar or even worse rates of default, Blumenthal alleges" Richard Blumenthal, Connecticut Attorney General, July 30, 2008 (Blumenthal is now governor of Connecticut)

Section V of the complaint, referenced in the heading above, teaches us something about how S&P treats government entities.

"Since at least 2001, S&P has known that it underrates public bonds as compared to corporate bonds and that this policy costs public bond issues money in the form of higher interest costs or unnecessary bone insurance costs. Despite knowing these facts, S&P continued to represent that its credit ratings are on the same scale, that public issuers have the same credit risks as similarly rated corporations, and that public bond issuers with lower credit ratings have a greater likelihood of not paying their bonds than a bond issuer or corporate bond issuer with a higher credit rating. These knowingly false representations harm public bond issuers when the buy bond insurance based on their own ratings and bond buyers who consider S&P's credit ratings when deciding to purchase public bonds." (Athor's emphasis) State of Connecticut v. the McGraw Hill Companies (p. 12)

Here's a credit firm that takes money from local governments and citizens by issuing ratings it knows are flawed. This is the same credit rating firm wielding major influence on the US budget process. There is no doubt that S&P's influence will work against the interest of citizens.

More Economic Fiction from the The Money Party

S&P has no credibility. Members of Congress should read the report form their own joint committee to understand the role of S&P in the current financial troubles. They should review the complaint against S&P from Connecticut. They should look at the comments on US sovereign debt from the underlying source for S&P's numbers on sovereign debt, CMA. In a report for first quarter, 2011, CMA rated the US as one "Top 10 Least Risky" nations likely to default on its sovereign debt. Here are CMA's precise words

"The U.S. ended slightly wider on the quarter as signs of growth finally started emerging." CMA Global Sovereign Debt Credit Risk Report, 1st Quarter 2011

There are bad actors operating with ill intent. They seek a grand solution to that pesky problem of public debate and citizen involvement in major decisions.

William Grieder summarized the dialectic from here on out: "If you listen closely, Obama is setting himself up to fashion another grand compromise with the right. He will explain this is the adult thing to do" April 20.

This citizen cram down will occur without the least bit of citizen involvement.

They hold us in total contempt. We are nothing to them.

END

This article may be reproduced entirely or in part with attribution of authorship and a link to this article.

del.icio.us

del.icio.us Digg

Digg

Post your comment